Ohio Low Voltage Contractor Insurance

9:00am - 5:00pm Mon-Fri

We'll Reply in 15min*

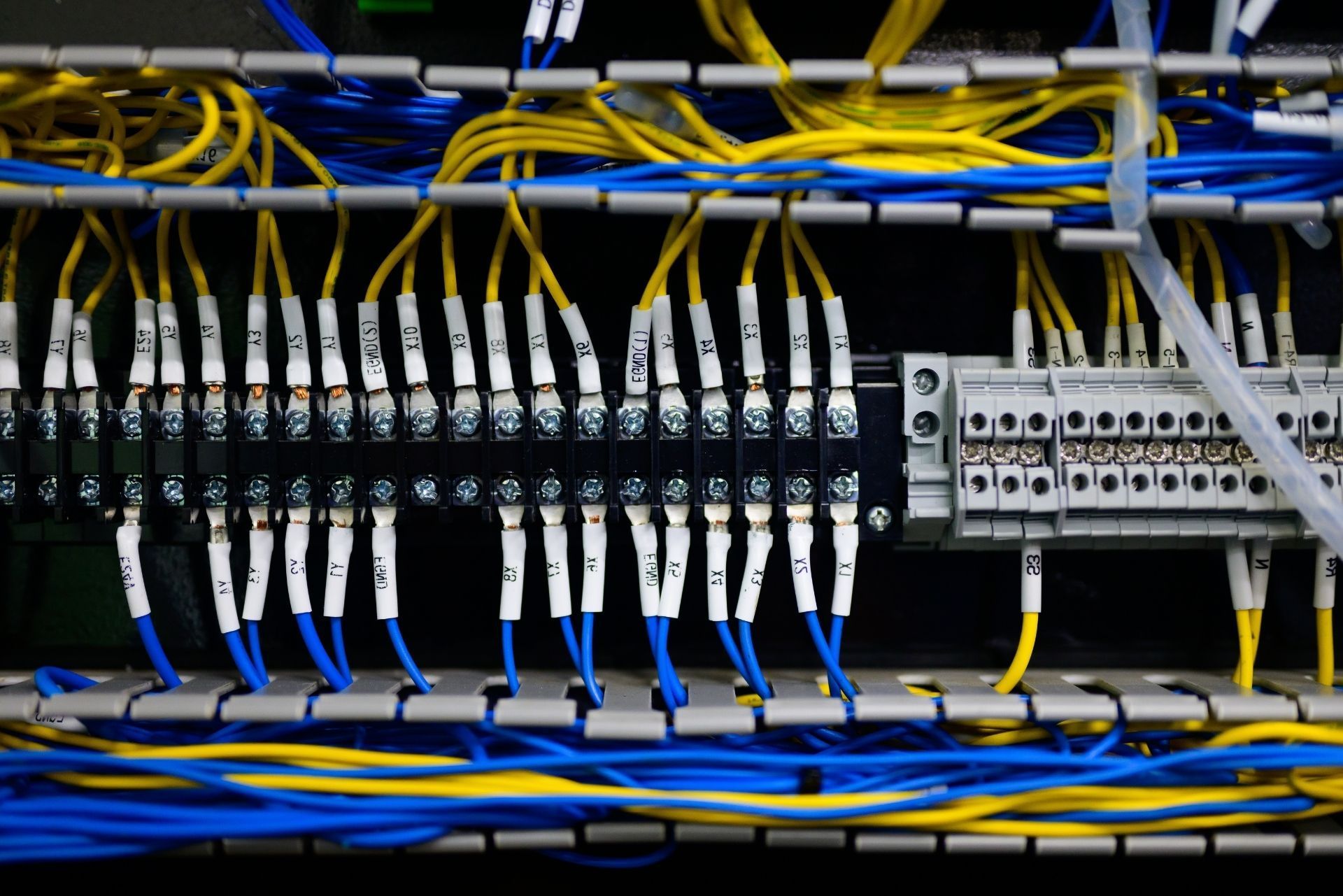

A sudden malfunction in a control panel or an unexpected surge in a building's smart system can easily cost a low voltage contractor thousands if a claim ever arises. With Ohio’s unique regulatory environment and market conditions, a well-rounded insurance policy isn’t a luxury-it’s a necessity. For detailed insights on how premiums are calculated and what coverage levels work best, experts have examined current trends and key factors such as liability limits and environmental risks. Read on for practical advice woven with current data, including advice backed by resources like industry insurance insights.

The guide below outlines the coverage options available, cost determinants, and recent legislative developments that affect low voltage contractors across Ohio. The aim is practical and straightforward guidance that addresses real-world operational challenges for contractors in this niche field of electrical work.

Understanding Low Voltage Contractor Insurance

Low voltage contractors face a range of potential risks-from property damage during complex installations to cybersecurity vulnerabilities introduced by IoT systems. Insurance coverage tailored for low voltage work not only protects against traditional risks but also covers emerging threats that are specific to the technology-driven work processes.

A typical policy for low voltage contractors often includes general liability, professional liability, and sometimes even pollution liability coverage. Each of these plays a key role in ensuring that contractors are well-protected in the event of an accident, damage, or claim. For instance, statistics indicate that general liability premiums for electrical businesses in Ohio range between 0.36% and 1.53% of annual revenue, making it crucial to balance between adequate coverage and cost efficiency

(contractornerd.com).

By: Aaron McElwain

President of Bellwether Insurance

Essential Coverage Types for Low Voltage Contractors

The nature of low voltage work necessitates a comprehensive insurance portfolio. The first component typically covered is general liability insurance. This type of coverage is designed to protect against claims related to bodily injury, property damage, and personal injury due to daily operations on the job site.

Experts in the industry recommend setting liability limits of at least $1 million per occurrence and a $2 million aggregate to ensure sufficient protection against potential claims (contractornerd.com). Such limits may seem steep initially, but the investment often mitigates the risk of significant out-of-pocket expenditures in the event of a major claim.

General Liability Insurance

This coverage typically caters to unexpected events. For low voltage contractors, incidents might include accidental damage to client property or injuries sustained by third parties during setups. The risk factors increase with the integration of sophisticated digital systems, and claims as observed in water damage alone account for about 23% of all insurance cases in the broader construction field (eqinsurancepartners.com).

With precise risk management, the calculated premiums based on annual revenue percentages can help adjust the protection levels needed. Such calculations offer insights into the financial planning necessary to maintain a viable business.

Professional Liability and Cyber Coverage

Professional liability insurance is essential for contractors who provide consultancy services or expert advice in the installation and maintenance of low voltage systems. This coverage ensures that errors or oversights in such specialized services do not result in crippling legal claims.

A significant emerging risk involves IoT technology. As contractors adopt more connected systems, cybersecurity threats and network failures become real concerns. Advanced cyber coverage options specifically address these vulnerabilities and help safeguard both digital assets and the reputation of the contractor (contractorinspro.com).

Pollution Liability

Pollution liability protection has seen increased adoption rates, rising by about 11.2% among construction firms recently (coinlaw.io). Although low voltage contractors may not always directly handle hazardous materials, projects in modern construction can involve environments where pollutants or by-products are present. This coverage becomes particularly relevant when working on larger, more complex setups.

Given rising environmental concerns and tighter regulatory frameworks, having pollution liability coverage helps contractors navigate any unforeseen environmental claims with greater confidence.

Cost Implications and Factors Affecting Premiums

Understanding premiums may seem daunting, but breaking down the main factors makes it easier to plan. Business revenue, risk exposure, and even the specific tasks performed all feed into the calculations behind the cost of coverage. In Ohio, premium costs for electrical contractors tend to vary significantly, with ratios ranging from 0.36% to 1.53% of annual revenue (contractornerd.com).

Costs in the industry have been on an upward trajectory due to several factors. Rising prices for supplies, labor, and insurance premiums have collectively pushed the overall cost of liability coverage higher. Inflation particularly influences the adjustments in premiums and medical treatment expenses linked to claim payouts (insurancejournal.com).

Calculating Insurance Premiums

When calculating premiums, insurers take into account various data points. For instance, contractors might see their costs calculated as a percentage of their annual revenue. For smaller operations, even modest premiums can become a noticeable expense, while larger businesses benefit from economies of scale.

Another component is the combined single limit (CSL) for construction insurance. Recent industry reports show that the average CSL reached around $2.1 million in 2025 and note a noticeable trend where more policies now meet a minimum CSL of $5 million (eqinsurancepartners.com). This increase in CSL programs reflects a growing emphasis on ensuring robust protection in light of higher overall project values.

Impact of Legislative Changes

New legislative efforts in Ohio also impinge on how contractors manage risk. The Ohio Insurance Agents Association is in support of Senate Bill 77, which mandates that roofing contracts exceeding $750 be in writing with specific details to combat fraud by so-called "storm scammers" (ohioinsuranceagents.com). Although this legislation directly targets roofing contracts, it serves as a reminder that clear contractual documentation can help mitigate disputes and clarify responsibilities, a principle that applies broadly across contracting work.

Legislative changes can lead to adjustments in premium structures, as insurers adopt risk-sharing strategies or mandate additional coverage. Keeping abreast of local regulatory shifts helps contractors anticipate additional costs and plan their budgets accordingly.

Risk Management and Mitigation Strategies

Insurance is only one part of a comprehensive risk management strategy for low voltage contractors. On-site safety protocols, proactive maintenance of systems, and comprehensive employee training can all help reduce incident rates. Regular safety audits and adherence to industry best practices ensure that accidents are minimized and claims remain infrequent.

Investing in risk mitigation not only reduces the likelihood of claims but can also result in lower premiums over time. Insurers often reward businesses with a demonstrated commitment to safety with favorable pricing and more comprehensive coverage options.

Mitigating Cyber Risks

The adoption of IoT and smart technologies requires a new approach to risk management. Contractors must now not only focus on physical risks but also on digital vulnerabilities. Cyber risks in low voltage installations can range from unauthorized access to system failures that halt operations.

Implementing robust cybersecurity measures is essential. Regularly updating system software, outlining clear protocols for data handling, and engaging cybersecurity consultants can help mitigate potential breaches. Insurance policies specifically tailored to cover cyber incidents have become increasingly important, given the rising adoption of smart technologies by contractors (contractorinspro.com).

Environmental and Pollution Risks

Despite the focus on digital risks, environmental hazards continue to play a significant role in shaping insurance needs. Construction sites can be prone to exposure to pollutants or accidental releases of hazardous substances, even when the primary focus is low voltage work.

Contractors should consider environmental risk assessments as part of their planning processes, especially when involved in large-scale projects where multiple contractors are on site. Increased adoption of pollution liability coverage, which has grown by over 11% in some sectors

(coinlaw.io), signals the growing importance of this safeguard.

A detailed comparison of coverage options provides a clear snapshot of the protections available and the associated costs. The table below breaks down the key types of insurance relevant to low voltage contractor operations, along with their primary benefits and considerations. This serves as a quick reference guide to help contractors understand where they may need to allocate their investments.

| Coverage Type | Primary Benefits | Considerations |

|---|---|---|

| General Liability | Protection against bodily injury, property damage, and legal claims | Premium percentage based on revenue; recommended limits of $1M per occurrence and $2M aggregate |

| Professional Liability | Covers errors, omissions, and professional mistakes | Essential for consultancy and design services; critical when working with complex systems |

| Cyber Liability | Addresses risks associated with IoT adoption and data breaches | Increasing in importance as technology plays a larger role in operations |

| Pollution Liability | Covers environmental risks, including accidental pollutant release | Growing adoption in larger projects; may add cost but improves project safety |

This overview helps highlight that there is no one-size-fits-all solution when it comes to contractor insurance. Contractors must weigh their exposure to various risks and select coverage that aligns with the unique demands of their operations.

Adapting to Industry Trends and Future Risks

Staying ahead means being proactive about emerging risks. The continuous evolution of technology in low voltage installations means that contractors must regularly review their coverage options and adjust limits where necessary. As IoT integration grows, so do the potential vulnerabilities linked to system failures and cyber breaches (contractorinspro.com).

The industry’s shift to cover higher combined single limits (CSLs) with averages reported near $2.1 million and a growing number of policies meeting a minimum of $5 million underscores the increasing importance of robust coverage (eqinsurancepartners.com). Such trends signal that low voltage contractors must not only invest in current protective measures but also plan for future upgrades in coverage as project scales expand.

Technological Innovation and Cyber Readiness

Technological innovation is driving the low voltage industry forward. Contractors are expected to incorporate advanced digital controls into building management systems and energy-efficient designs. As these technologies advance, the potential for system vulnerabilities increases.

Integrating cyber insurance policies alongside traditional coverages ensures that contractors can address both immediate physical risks and potential long-term digital disruptions. Investing in training and cybersecurity readiness is recommended to complement the insurance policies acquired.

Staying Informed and Flexible

Legislative updates, such as Ohio’s Senate Bill 77 which seeks to reduce fraudulent practices in contracting, leave their mark on insurance and risk management protocols (ohioinsuranceagents.com). Contractors should develop strategic partnerships with local agents who understand the market and can provide insights as regulations evolve.

Clear documentation and contractual clarity can reduce risks and improve claims outcomes, ensuring that both contractors and insurers have a mutual understanding of responsibility. This proactive approach improves trust and reinforces the overall resilience of the business.

Budgeting for Insurance as Part of Operational Costs

Integrating insurance premiums into the overall business budget is a strategic decision that affects profitability. When determining project bids and setting operational budgets, it is vital to factor in the cost of comprehensive insurance coverage. The percentage of revenue dedicated to insurance, which in some cases can be as notable as 1.53%, must be balanced against job profitability (contractornerd.com).

Budget forecasting for contractors now involves an understanding of both insurance trends and current market conditions. Rising supplies, labor, and overall premium costs require protective measures that might increase costs in the short-term but provide security and continuity over the longer run (insurancejournal.com).

Insurance as an Investment in Business Stability

While managing the bottom line is important, insurance should be viewed as an investment in the stability and reputation of a contracting business. The complexities of the installation process mean that even one major claim has the potential to destabilize operations.

With proper coverage, contractors are better prepared to handle unforeseen events, thereby protecting long-term profitability and client trust. A well-insured business signals reliability-a significant advantage in competitive bidding and client relations.

Dynamic Policy Reviews and Renewal

Because operational risks evolve, it is advisable for contractors to conduct regular reviews of their insurance policies. Policy renewals should reflect any operational changes, emerging risks, and legislative updates. Many local agents now offer review sessions tailored to low voltage work, ensuring that adjustments are both timely and accurate.

This strategy of dynamic policy management means that as business scales or pivots, the protection in place evolves alongside emerging market conditions and technological innovations. Finely tuned policies lead to lower long-term costs and a reduced chance of claim disputes.

Frequently Asked Questions

Below are answers to common questions posed by Ohio low voltage contractors regarding insurance coverage and cost management:

Q: What types of insurance should a low voltage contractor consider?

A: Essential policies include general liability, professional liability, cyber liability, and for larger projects, pollution liability. These cover physical damage, digital vulnerabilities, and environmental risks.

Q: How are insurance premiums typically calculated for electrical contractors?

A: Premiums are often determined as a percentage of your annual revenue, with common ranges between 0.36% and 1.53% in Ohio. Factors such as risk exposure, coverage limits, and industry trends influence these calculations (contractornerd.com).

Q: Why is cyber liability coverage important for low voltage contractors?

A: With the increasing integration of IoT technologies, contractors face risks related to system failures and cybersecurity breaches, making cyber liability an essential part of comprehensive coverage (contractorinspro.com).

Q: How do legislative changes in Ohio impact contractor insurance?

A: Regulations such as Senate Bill 77 prompt clearer contractual documentation and influence premium calculations by ensuring that insurers and contractors share a clear understanding of risks, helping to stabilize coverage costs (ohioinsuranceagents.com).

Q: What should contractors do to manage increasing insurance costs?

A: Employing robust risk management and proactive policy reviews can help minimize claims and, in turn, lead to more favorable premium rates. Balancing operational practices with insurance investments is key.

Q: How does coverage for pollution liability benefit low voltage contractors?

A: Pollution liability coverage addresses the fallout from environmental accidents and accidental release of pollutants, safeguarding contractors when projects run into unexpected environmental challenges (coinlaw.io).

Wrapping Things Up

Ohio low voltage contractors operate in a setting that blends advanced technologies with traditional risks, making a well-balanced insurance portfolio indispensable. With rising premiums tied to operational revenue and enhanced coverage limits now standard practice, staying informed about both the technology-driven and environmental risks is more critical than ever.

The landscape is moving quickly. For instance, a noticeable shift toward policies with combined single limits of $2.1 million or higher reflects an industry that is adapting to higher-value claims and a more complex web of exposures (eqinsurancepartners.com). By investing in tailored policies, regular review sessions, and disciplined risk management strategies, contractors create a stable foundation for their businesses and foster trust among clients.

Insurance should be seen as a proactive step that protects not just physical assets but also the reputation and operational continuity of a contractor. With clear contractual guidelines influenced by recent legislative updates, Ohio’s contractor community benefits from a regulatory environment that emphasizes transparency and solid risk management practices.

Final Thoughts on Navigating Insurance for Low Voltage Contractors

Choosing the right insurance is an ongoing process that involves evaluating project types, area-specific risks, and the ever-changing technological landscape. Low voltage contractors must balance between covering traditional liabilities and emerging hazards linked to cyber threats and environmental exposures.

The conversation around coverage should always be adapted to both current trends and anticipated future challenges. In this regard, staying connected with local experts and regularly updating policies can dramatically reduce the impact of a potential claim while securing business longevity.

Ohio’s market presents both challenges and opportunities. By diligently monitoring industry developments and budgeting intelligently for insurance costs, contractors can build a strong safety net for their operations. Ensuring peace of mind translates to a higher level of confidence on the job, allowing contractors to focus on the craft while staying protected against unforeseen losses.

About The Author:

Aaron McElwain, CIC

As President of Bellwether Insurance, I’m passionate about helping individuals and businesses protect what matters most through honest advice and reliable coverage. With my Certified Insurance Counselor (CIC) designation and years of industry experience, I focus on simplifying insurance, building lasting relationships, and delivering peace of mind through every policy we write.

OUR PERSONAL INSURANCE COVERAGE IN OHIO

Explore Personal Insurance Coverage in Ohio

We only work with outstanding insurance companies that offer great value and continually impress our clients.

Choose Bellwether Insurance Today for Personalized Protection

Get a Plan Tailored to Your Lifestyle

Bellwether Insurance evaluates the risks you and your family face, taking into account your assets, personal circumstances, and individual requirements to create a tailored insurance solution.

Recover with Confidence

With our personal insurance coverage, you'll be prepared to bounce back from unforeseen events that could have left you and your family in a difficult financial situation.

Avoid Overpaying

Through customized insurance plans, you'll receive adequate coverage without unnecessary costs. At Bellwether Insurance, we strive to keep premiums cost-effective while providing the protection you need.

Review from our Clients

Customer Testimonials

See why Ohio residents work with Bellwether Insurance Agency in LaGrange, Ohio

Arun K.

Personal Insurance Client

After a decade old relationship with a premium and commercial insurance provider.. my switch to Bellwether has left me wondering why I waited so long. Primarily my experience has been dealing with Jessica Fox.. and she's been awesome to work with. She's super responsive, stays on top to follow up on your enquiries and really gets things done to delight customers.

Rob J.

Personal Insurance Client

Absolute pleasure to work with. Sandra has taken care of all my insurance needs for over 2 years now. Bellwether was able to save me quite a bit of money over previous carrier. Always giving heads up on any changes, or weather it’s time to check for new price she’s on top of it. I recommend them often to friends and family.

Nick W.

Personal Insurance Client

Aaron and Sandra are amazing! I faithfully stayed with my previous insurance for over ten years until I had them review my policies. Wish I would have done it years ago. Saved me quite a bit of money as well as gaining coverage what's not to love? They respond very quickly and professionally. I work in sales as a profession so it's great to see that level of attention and attentiveness provided here. Stop your search and give them a shot you won't regret it. On a side note even though it is something so small I love the fact they send laminated copies of insurance cards anytime you make a change. 10/10

Bobby P.

Personal Insurance Client

Bellwether Insurance is the best ever! Always there when I need them and always has the answers with quick replies. I will never go with a different Insurance Agent. If I could, I would give then a 10 Star review! Thanks Sandra for all your help!